There is More Than One Way to Support

Embrace the power of versatility! Beyond traditional methods, be an Ally for change while you shop, host a fundraiser, provide in-kind items, mentor clients, or offer your resources. Your unique contribution style makes a diverse impact on the lives of individuals with unique abilities.

How To:

- Imagine Rachel, an Ally who donated a portion of her online store proceeds, contributing $75 to support vocational training programs.

- As an Ally, participating in Fred Meyer Rewards or Walmart's Online Roll-Up Programs allows you to seamlessly and easily support Columbia Ability Alliance with purchases you are already making.

- Imagine Jerry has a birthday upcoming, but rather than accepting gifts, he wants his family and friends to donate to CAA on his behalf.

If you have questions about how to get involved, please get in touch with our Philanthropy Officer.

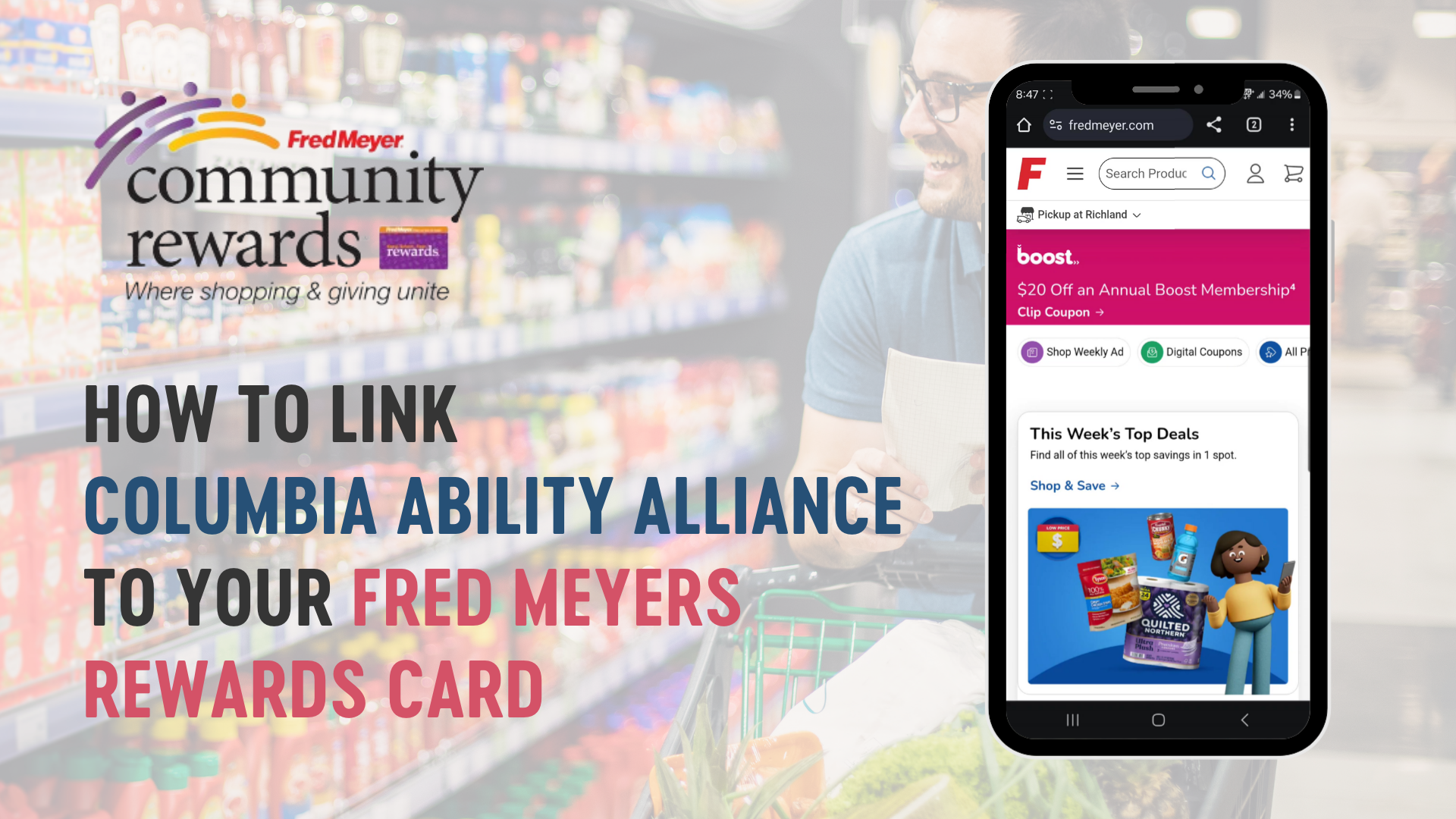

Shop with Purpose at Fred Meyer

Enroll in the Fred Meyer Rewards Program and select Columbia Ability Alliance as your designated nonprofit. Every time you shop with your Rewards Card, you contribute to our cause.

Check out our video on how easy it is to link us to your Fred Meyer Rewards Card account!

Round Up with Wal-Mart's SparkGood Program

Make your online shopping count by participating in Walmart’s Online Roll-Up Program. Round up your purchase to the nearest dollar at checkout, and the extra change goes directly to Columbia Ability Alliance.

Check out our video on how easy it is to link us to your Wal-Mart account.

Join Our Community of Allies

When you give – You are joining the hundreds of other community-minded individuals who believe that those of all unique Abilities can find success.

When you give – You are an exclusive member of the Ability Allies Society – a conglomerate of inspired philanthropists.

When you give – You proudly walk shoulder-to-shoulder with true change-makers.

Columbia Ability Alliance is a 501(c)(3) nonprofit organization.

Tax ID: 91-0776525

Tax notice: The content presented on this website is not meant to serve as legal or tax advice. Individuals interested in making donations should consult with a qualified financial planner or tax professional for personalized advice based on your unique financial situation.